Pa Estimated Tax Payments 2025

BlogPa Estimated Tax Payments 2025. You must send payment for taxes in pennsylvania for the fiscal year 2025 by may 15, 2025. You can pay minnesota estimated tax any of these ways:

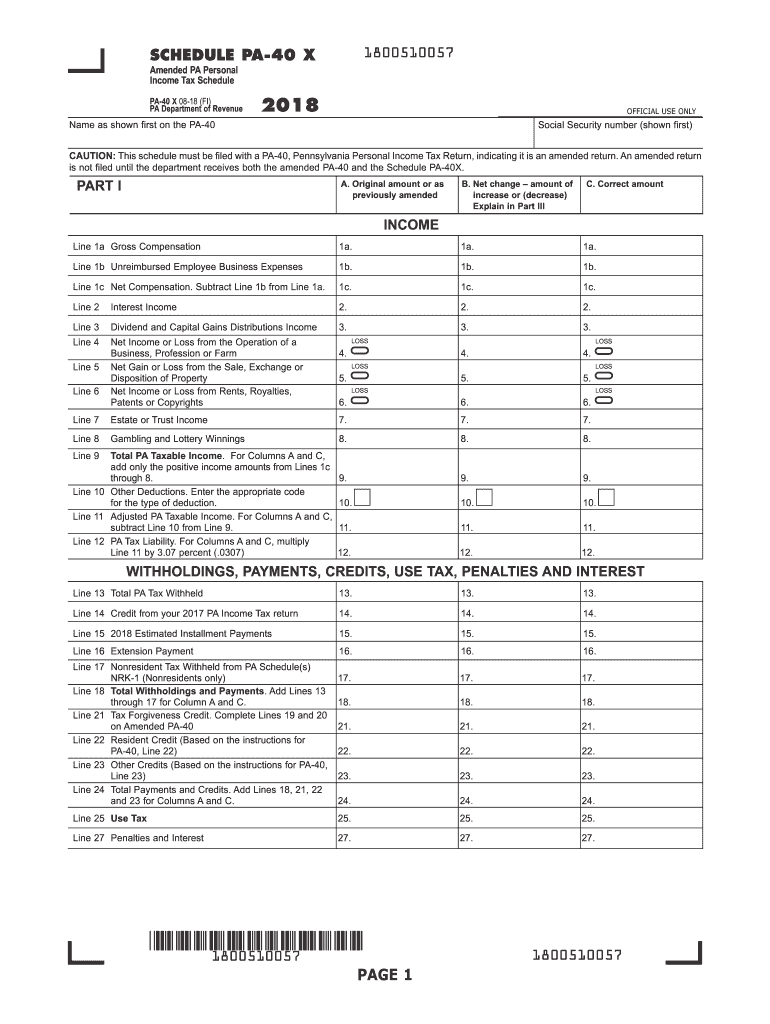

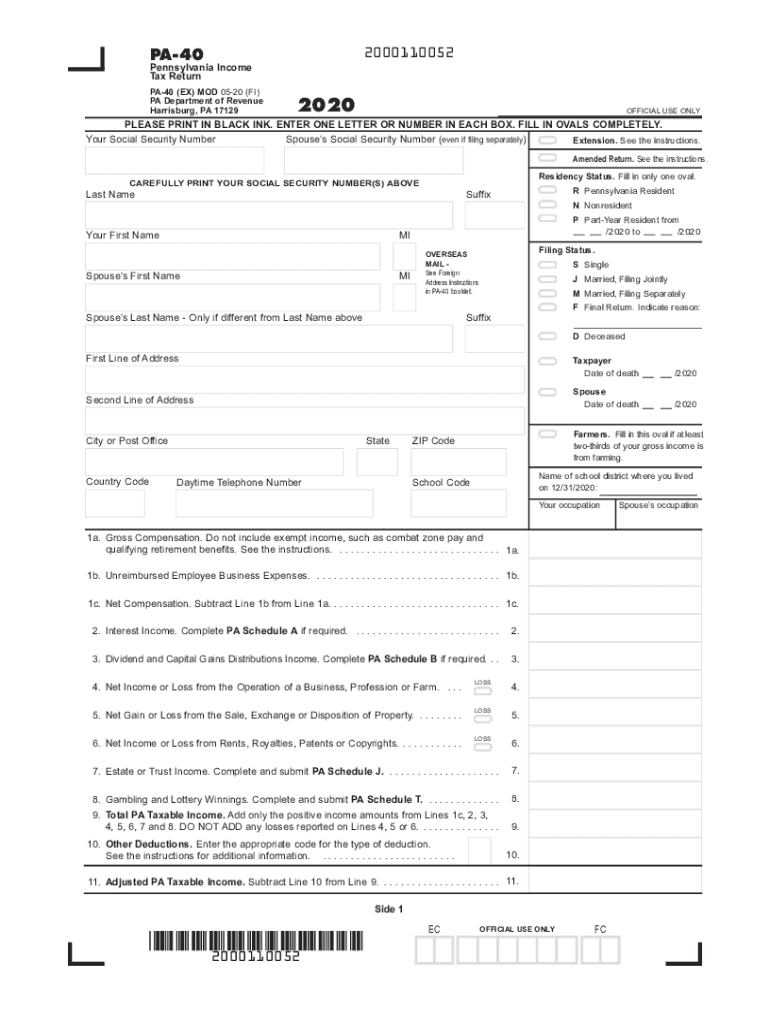

Estimated underpayment penalty is calculated on the amount of underpayment for each installment period multiplied by both the daily interest rate for the tax year (and the. The declaration of estimated tax provides a taxpayer a means of paying commonwealth personal income tax on a current basis if the taxpayer has taxable income not subject to.

This year’s budget losers by stephen caruso, kate huangpu, and katie meyer of spotlight pa | july 15, 2025

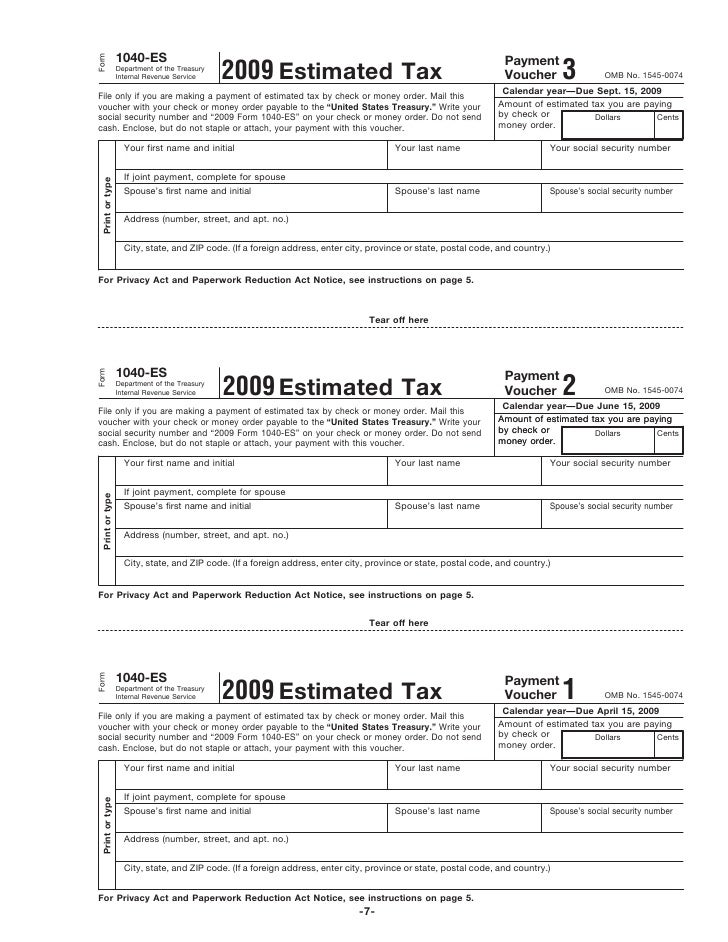

Pa Estimated Tax Payments 2025 Due Dates Tina Adeline, You're not required to make estimated tax payments; When are business estimated tax payments due in 2025?

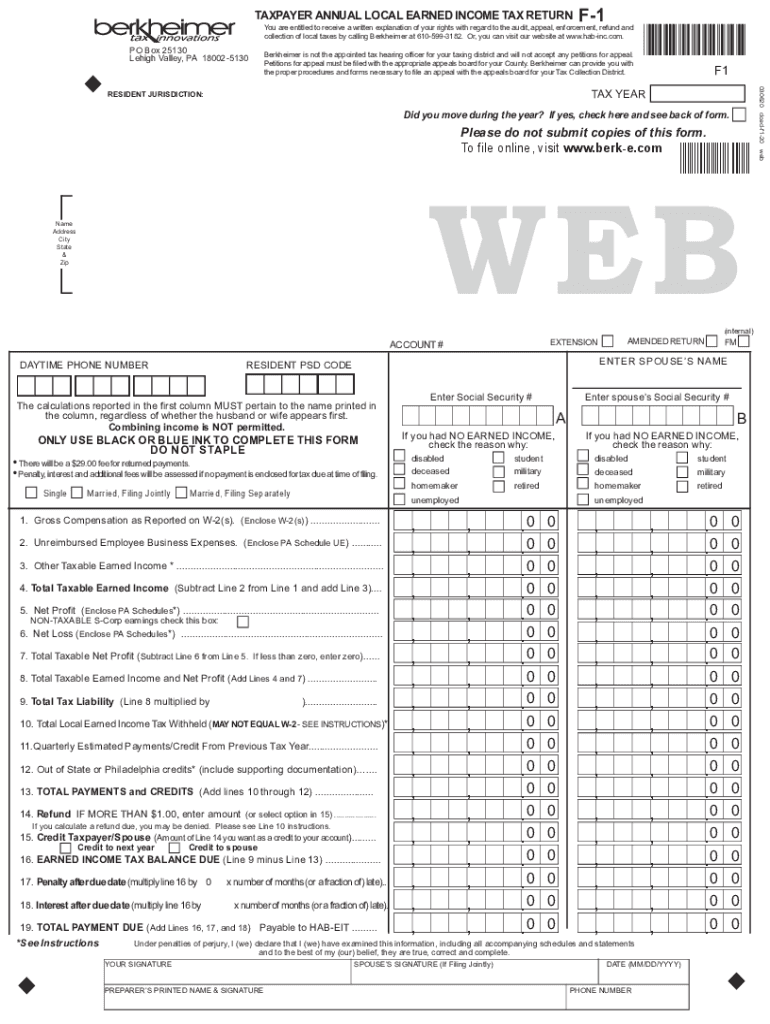

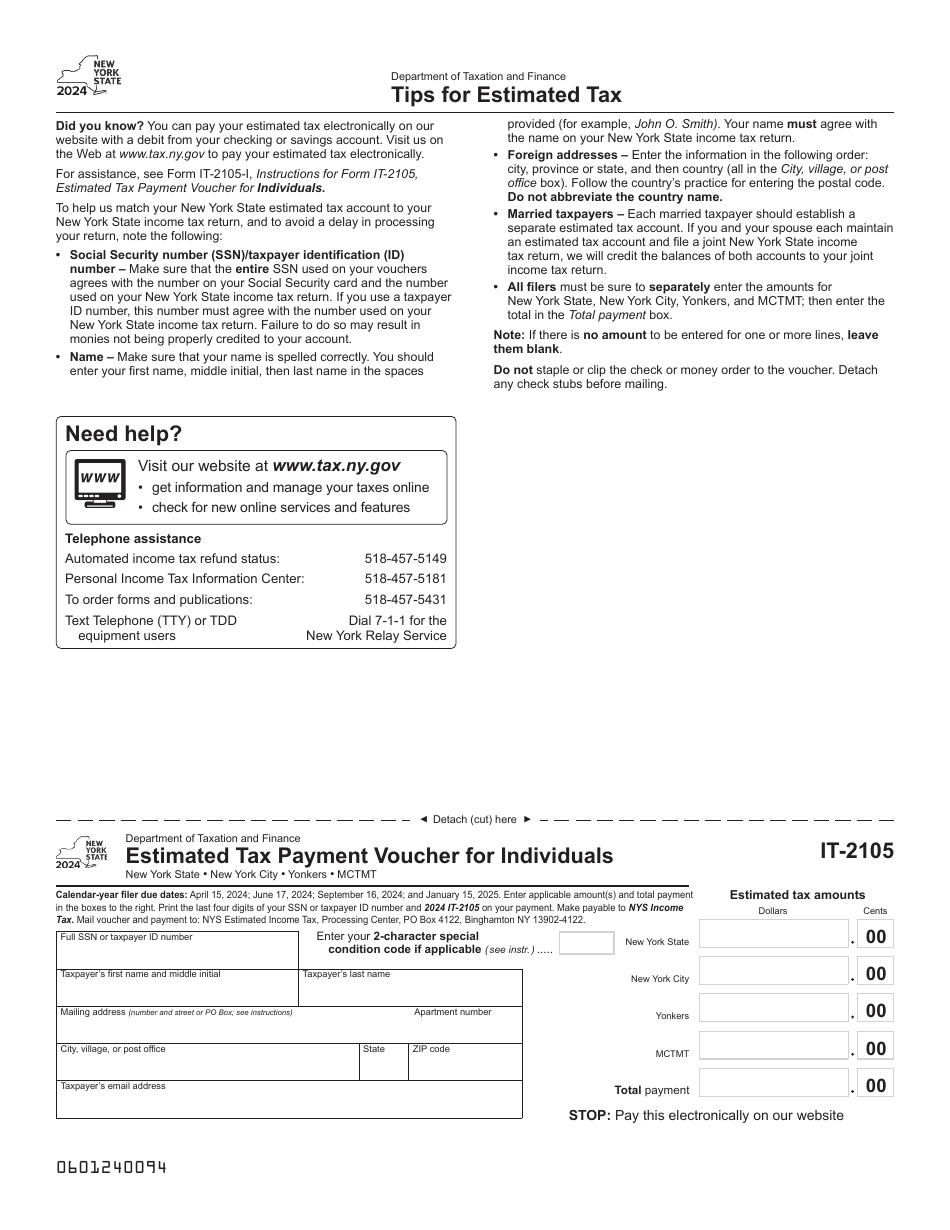

Pa Estimated Tax Vouchers 2025 Tory Ainslee, Some pennsylvania taxes are reported and paid on a quarterly basis. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Pa State Tax Forms 2025 Sal Lesley, Enter your details to estimate your salary after tax. Here are the following options for making estimated tax payments:

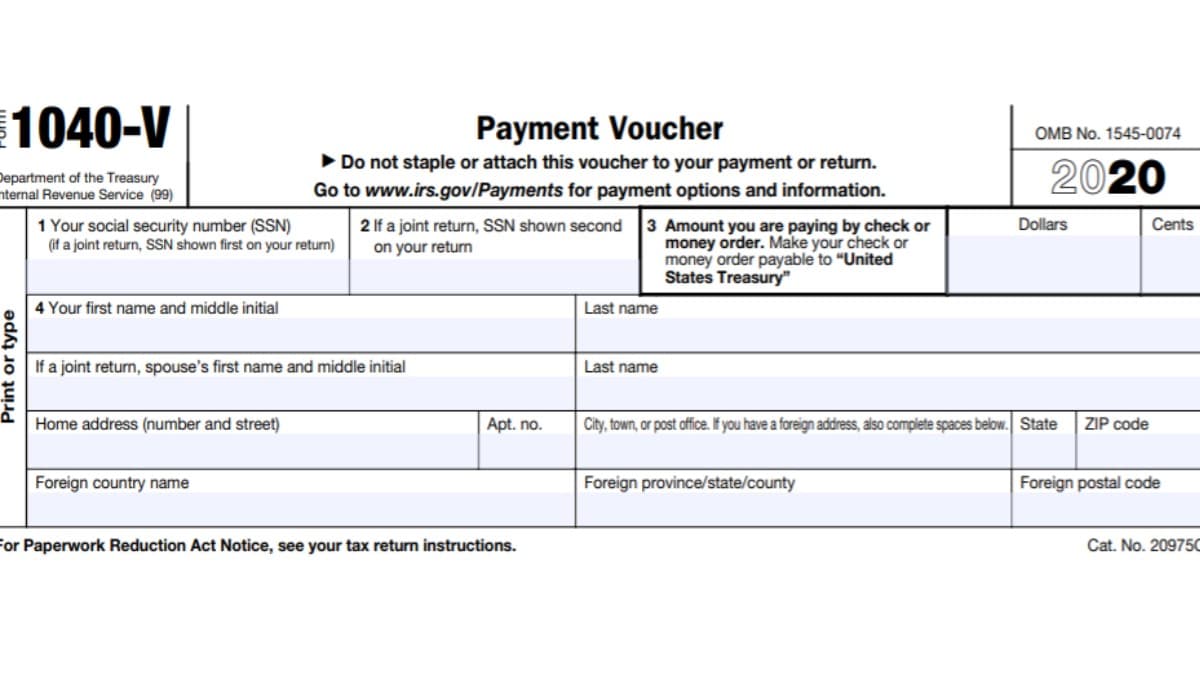

Federal Estimated Tax Payments 2025 Form Bibi Marita, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. Estimated underpayment penalty is calculated on the amount of underpayment for each installment period multiplied by both the daily interest rate for the tax year (and the.

Berkheimer Local Earned Tax Return F 1 20202024 Form Fill Out, You're not required to make estimated tax payments; You can pay minnesota estimated tax any of these ways:

Pa Estimated Tax Payments 2025 Elana Melisa, Some pennsylvania taxes are reported and paid on a quarterly basis. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Pa Estimated Tax Payments 2025 Forms Sioux Eachelle, Legal marijuana, big tax cuts, and minimum wage: Income tax changes in budget 2025:

Pa Quarterly Tax Payments 2025 Eula Rosemarie, If you feel they're not needed for next year's taxes, you can shred. This year’s budget losers by stephen caruso, kate huangpu, and katie meyer of spotlight pa | july 15, 2025

Pa Quarterly Tax Payment Forms 2025 Dode Carlotta, Taxpayers including sole proprietors, partners and s corporation shareholders must make estimated tax payments if they expect to have a tax liability of $1,000 or more when they. You can make a single.

Pa Estimated Tax Payments 2025 Voucher Ulla Alexina, It’s important to note that taxpayers. Not all freelancers and independent contractors.

This year’s budget losers by stephen caruso, kate huangpu, and katie meyer of spotlight pa | july 15, 2025